https://twitter.com/the_Hotstar

In August 2019 BlackRock released a white paper proposing a new economic paradigm1. A few months later, in that fated month of March 2020, their proposal became policy and the global economy entered into the endgame of the economic cycle of the past fifty years2.

To understand the significance of this is to understand the nature of this cycle, and to understand that there was only ever one way out of it.

This essay is extremely long so here's the crux. A financial oligarchy made up of families emergent from high concentrations of capital required to stitch together the backbones of industrial society, have for the past fifty years consolidated their wealth into customary power, both social and financial, and used this to craft from behind the scene perpetual cycles of debt that have been used to finance mergers & acquisitions between corporations and financial institutions and to consolidate the control of assets within them. However, in doing so they have rendered these institutions insolvent and unable to ever pay off the debt amassed, and so this debt is being gradually inflated away through bold new economic policies designed to necessitate a currency reset onto Central Banking Digital Currency. Crucial to this process has been the rise to power of modern mutual funds, most notable among them BlackRock. These have come to play a central role in what has been, for the past fifty years, a conspiracy of the business cycle.

Economic cycles are as old as civilisation itself, having existed ever since agriculture and city-life constituted the very first civilisations of Mesopotamia. Back then, priesthoods of astrologers had figured out how to predict the flooding cycles in alluvial river valleys by studying the position of the Sun, and had used this specialised knowledge to elicit a portion of the crop yields from farmers. Such an exchange was an early form of taxation, making these priesthoods the first institutions of government(public authority). They controlled the agrarianism economy by crafting seasonal calendars that allowed societies to navigate natural weather patterns, and from this amassed a surplus of wealth which was used to finance public works such as roads and irrigation.

Since that time, institutions of surplus wealth, that is, those who control the distribution of incomes generated through mass productive activity; have generally been the most powerful. Whether an institution's power(ability to impose one's will on others) resided in religion(persuasion), military(force), or commerce(bribery); such means have generally been used to achieve economic ends. Which is to say politics is really economics.

But within our modern industrial societies, at least those making up western civilisation, public authority does not control domestic economies. This is because over the course of around 250 years, governments have gradually given up real control of two things:

Incorporating power. The ability to control the function and lifespan of corporations to prevent them usurping power from governments. This control had been maintained through a charter system, which like all things, eventually became corrupted.

Control of the supply of money and credit. Control of this was lost to a central banking system.

Because of these developments, modern governments for the most part are no longer sovereign. A fact readily observed in their inability to leverage even the most populist mandates into real power, such as the power to tax corporations.

These political developments have led to the institution of private control over the supply of money and credit. This control in turn been used to gain control of the modern economic cycle. This cycle is not a natural one like seasonal flooding, but one manufactured through the creation of what could be called synthetic financial instruments.

The modern economic cycle is no longer localised by climate or protectionist tariffs, as it has become planetary through the interdependency of globalisation. Though for most of the 20th century and for at least a little while longer in the 21st, its nexus has been and remains the American economy, whose dollar serves as the world's reserve currency. It is here, since at least the 1970s, that the economic landscape has been controlled almost entirely by the Rockefeller family and a legacy of financial institutions sourrounding them. For much of the latter half of the 20th century this was no secret, though since the 1990s it appears to have become one.

Over the last fifty years or so, the concentration of Rockefeller private control over the US economy has been used to manufacture a business cycle of crisis, for which there have already been two iterations, and a third in which we currently reside near ocnclusion. This cycle of crisis has been designed somewhat as a swan song to an industrial era set to crescendo into a new precarious social framework for 21st century. There are many names for this. The Fourth Industrial Revolution. The Great Reset. Etc. Call it what you will, but the overarching aim is to bring about a type of corporate feudal state, which a certain branch of western philosophy believes is the best chance of creating a utopia through civilisational totalitarianism.

This crisis cycle, as we have come to known it over the past 50 years as 'the business cycle', is the following in brief:

- A boom period is initiated through the lowering of interest rates and increased availability of cheap credit through commercial banks.

- This cheap credit is used to acquire assets like real estate and stock, creating bubbles in those markets, while corporations use it to finance leveraged mergers & acquisitions between themselves.

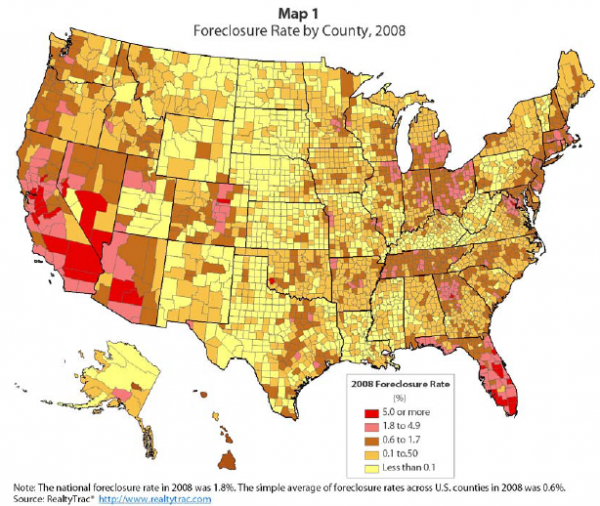

- A bust period is initiated through hiking interest rates and restricting credit, which bursts the market bubbles that have been crated. The assets in these markets lose value and become non-performing liabilities. Loan repayments start to be defaulted on, and these assets are acquired by the commercial banks through foreclosure.

- A crisis period is initiated through the banks acquiring all these nonperforming assets, which become liabilities on their own books. These commercial banks then become insolvent and can no longer account for the money in depositor accounts.

- A bailout period is initiated through government acquisition of insolvent commercial banks or their assets. The government then liquidates these by first selling the performing assets to other bigger banks or private equity firms at heavily discounted prices, followed by dumping all the bad assets back onto the market through mortgage-backed securities and other financial derivatives used by mutual funds tranfer the burden to retail investors and/or pension funds.

The economic response to step 5 is then step 1, and the cycle repeats. Boom. Bust. Crisis. Bailout. Recession. . .Boom— And as it does , the following occurs:

- The consolidation of financial institutions.

- The consolidation of assets within those institutions.

- An increase in government and corporate debt.

- An increase in the prices for goods and services.

- A decrease in the quality of goods and services.

- A decrease in middle and lower class incomes and savings.

- An increase in upper class incomes and savings.

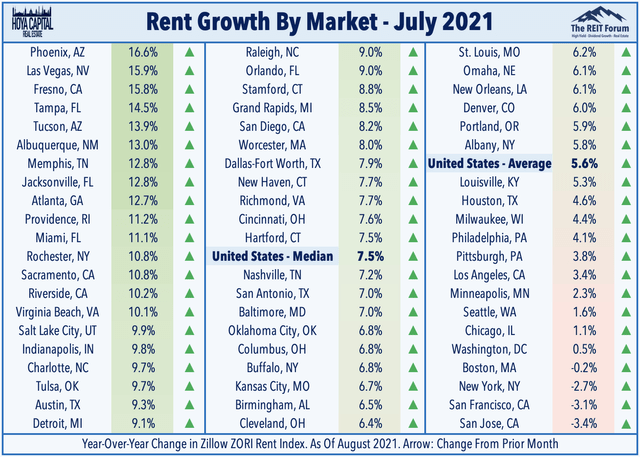

The end goal is to consolidate all assets, including residential property, within a few financial institutions 'too big fail', so that the debt budrden amassed from doing this must be forgiven. What eventuates from this system, if followed to its logical end, is a two-tier economic landscape of renters and corporate landlords. And rents may not necessarily be paid from income.

A population of renters whose labour is gradually replaced by automation become superfluous, as they cease to generate incomes. What this would mean is many could only pay rents through good behaviour, which would manifest itself in a universal basic income pegged to a social credit score.

The culprits behind this cycle are not banks. As banks are corporations and corporations are not people, regardless of what lawyers would think. We are not talking about faceless institutions here. It is dishonest, or at best naïve, to anonymise this process through identifying the prime movers as institutional, or corporate entities. This only gives an identity to the villain, not a personality. Which is to say, it gives no substantive understanding as to where real power resides within modern society. Because behind the body corporate is a soul of very real vested interests. The vested interest of real people. They are not employees. Nor are they CEOs. They are only sometimes board members, and often times they are not even stockholders. But they are people with personalities and those personalities have names, and they make up what can be called a modern financial oligarchy.

This modern financial oligarchy is an internationalist fraternity of mutually vested interests, probably no more than a thousand people, being the limit of everyone knowing everyone else through at least reputation. That is segmented into factional divisions of kinship groups, or family dynasties, which maintain estates of intergenerational wealth, and who manage succession through a balance of ability and blood. In the past many preserved the legacy of their names and genetics through restricting marriages of their progeny to within the fraternal network of families, at times within their own. Though modern practise brings in outsiders of ability through marriage, generally as son-in-laws, married into the family to takeover business operations and avoid the estate collapsing under the stewardship of an incompetent heir, or becoming overrun by the managerial class built up beneath it. This can be seen as a sort of cross breeding between old money and new. Old money providing the pedigree of legacy and new money fresh talent. A balance between blood and ability to perpetuate the legacy of both bloodline and estate.

The interplay between new money and old is the basis of an age old dichotomy of power structures. In our modern era the stock market is the institution used by old money to control new money power, particularly that built up in modern technology corporations. Technology entrepreneurs, such as Bill Gates, Jeff Bezos, and Elon Musk can only access their wealth through giving up control of what they create in the form of publicly traded corporations. By the time they have cashed out their stock and shifted the proceeds into philanthropic foundations, this another area tightly controlled by old money institutions, they have handed control of their innovations to the financial institutions of old money, being custodian banks and mutual funds. Both these are explored later as thet are the main focus of this piece. It is for this reason new technology innovation begins with a promising implementation period, which provokes its mass adoption, followed by a swift curtailment of its potentiality. As an old saying goes, you cannot put new wine into old bottles. The old bottles break and the new wine spills out.

The economic crisis cycle was manufactured by the most prominent family of Anglo-American oligarchs, the Rockefeller family. They achieved this through controlling the appointments to key positions within the US Treasury and Federal Reserve. By doing this they were able to determine economic policy governing the supply of money and credit in US dollars. They also controlled the Resolutions Trust Corporation and the Federal Deposits Insurance Corporation, two government corporations tasked with liquidating the assets acquired from insolvent banks using government bailouts at the end of each crisis cycle.

Further more, nakedly corrupt practises such as political lobbying(bribery), and other more nefarious means(blackmail, think Jeffrey Epstein), were used to ensure that control within the legislative branches could be leveraged periodically to deregulate the lending practises of retail banks, abolish antitrust laws restricting mergers and acquisitions, and approve bailout packages for insolvent financial institutions.

So far there have been two of these crisis cycles, and we currently reside within the end of a third in 2022. They can be arbitrarily defined into the periods:

- 1970-1990

- 1990-2010

- 2010-Present

Out of this cycle emerged two institutions to help facilitate the mass acquisition of private property. These were the private equity firm, The Blackstone Group, and its mutual fund progeny, BlackRock Inc. Both these, their origin and operations into the present, are the primary focus of this essay as both became institutional prime movers behind the crisis cycle.

What has transpired economically over the last fifty years is no doubt a conspiracy in the traditional sense of the word. However, the use of such a term has come to carry the connotation of a fantastical cabal with absolute control of absolutely everything, and that everything decided by this cabal is carried out by people 'in on it' at the tactical and operational level. Which sets up a strawman that can be easily debunked by pointing out how impossible it would be to keep such a thing of such grand scale secret with so many people involved.

It is true that a small community like this does exist at the strategic level, who are the aforementioned families of the financial oligarchy. But they are not absolutely united in interest or intention, which is to say there are many smoke filled anterooms surrounding what amounts to a smoke filled hall, probably operating like a de-facto sort of parliamentary system to determine consensus on a strategic agenda. Beyond this however, they rarely control what happens at the tactical or operational level. And people at the tactical and operational level needn't know what the aim at the strategic level is. Modern human organisations are highly compartmentalised operations. Operational roles, and even managerial ones, have come to be occupied by atomised individuals in ever more specialised areas of knowledge. Which means the modern working professional often has very little understanding for the context surrounding the area of their own narrow focus. Put simply, modern professions are often incapable of seeing the bigger picture of their industry because their education has become narrowly focused.

An easy way to conceptualise this conspiracy in a normalised manner is through a sporting analogy. There is an economic game being played by athletes at the operational level, and this is what spectators see. The athletes play within the rules of the game and their actions determine the results. But how they are playing is moderated by how the rules of the game are enforced by referees, at say the managerial level. Further more, the sporting league itself sets and adjusts the rules to determine the nature of the game itself at the strategic level. Control from the top down is indirect and not entirely rigid, but still exists. But of course, all the focus remains on the athletes. Or referees. Rarely ever the league itself. The more the league wants to influence how the game is played the more attention they will bring on themselves. Leveraging their power comes at the cost of their incognito status. So often they will not change the rules directly, but change the way in which referees enforce them.

Not everyone is in on it, and those who are do not control everything. Nor do they necessarily share the same motivations. But the game is set up in such a way as to ensue that at least a few critical outcomes serving a collective vested interest are met. And these outcomes can be reached in any number of ways through how things play out below in the managerial and operational tiers. The substance of the game remains the same even if the consistency of the form in which plays is flux.

The economic game being played here is a cyclical and often conceptualised as a wave. Investors trying to figure out, guess, or know when to start paddling onto it and when to get off before it crashes.

The way the business is moving now, you really have to learn to surf the wave

But this wave is generated by a wave-pool not the ocean. Because the modern business cycle isn't one governed by the moon, but by financial institutions more aligned with Saturn. With the Kaaba. The Blackstone.

The aim of the economic crisis cycle is to gradually create a society where human behaviour, as an aggregate defined by culture, becomes controlled through rental agreements which moderate access to the material goods and services required to fulfil human needs. A similar thing was attempted in the twentieth century using consumerism, which was the control of human desires, or things people think they need but don't. These rental agreements will allow corporations to control the social aspects of societies historically controlled by communities. They want to control this because communities govern a person's internal controls, or what are more commonly known as responsibilities. A responsibility is the self-enforcement of one's own behaviour so that they can be accepted by others. A person does this because it allows them to fulfil their social needs through the establishment and maintenance of interpersonal relationships.

The notion of a social contract has led to confusion over what the nature of responsibilities are. Responsibilities are nothing other than what people are compelled to exchange with others to meet their human needs. People form relationships to fulfil needs, and implicit in these relationships are responsibilities they must meet. This is what a therapist will charge thousands to explain to couples with relationship issues. They'll make the couple conscious of the nature of their relationship by helping them to openly recognise the exchange of responsibilities for needs between, so that these can be brought into an agreed upon balance that is mutually recognised by both as beneficial. The social contract purports people have a responsibility to society, but they don't. Because people only have responsibilities to their communities. One could argue that communities have responsibilities to their society, but not the individuals within those communities. The social contract is actually aimed at destroying communities as it's totalitarian in nature. Because an individual who fulfilled their social human needs at the societal level, would be living in one universal community governed by the State.

Anyhow, control of social responsibilities are to be transferred from communities to corporations, through rental agreements, because the only alternative to controlling human behaviour through social responsibility, is through the use of external control. This is the use of force like police force or military force. But the use of external control is unsustainable as it creates political instability, in things such as revolution, a pattern human civilisation attests to, and one readily recognised by the think tank philosophers charged with crafting future models for stable governance in an ever more unstable industrial society.

Corporation control of individual social responsibilities is also being achieved through a dialectic on the ideological front. Both left and right now work together in different ways to destroy the only two things standing between them and complete corporate control, community and government. If the left successfully destroys communities, and the right successfully destroys government, what will remain are corporations and socially naked individuals.

The extent to which this process is already underway can be observed in modern phenomenons like cancel culture. Cancel culture is corporate governance of human behaviour controlled through careful curation of the corporate news cycle.

As confusing as the financial system has become, it is still remains easy to understand at a macro level. As its function is the hallmark of many civilisations that declined, most notably classical Roman. It is simply the process of supplementing quality for more quantity. That is, to achieve further growth, financial institutions have reduced the quality of loans given to increase the quantity of them made. Many complex mechanisms have been invented to achieve this, but there is no need to know the intricacies of these alien financial techniques, such as mortgages broken into bonds packaged into Mortgage-Backed Securities(MBS) arranged as Collateralised-Debt-Obligations(CDOs) hedged with Credit-Default-Swaps(CDSs), all placed as assets inside of Real-Estate-Investment-Trusts (REITs)making up the assets of Exchange Traded Funds (ETFs)floated onto the stock market. All this hookuspookus is just a means of hiding a reduction in the quality of loans given. So a simple mortgage becomes an MBS(CDO(CDS))-REIT-ETF. What this aims to achieve is a debt based stimulus of perpetual growth which equates to a cancer economy. Because that is what we have.

If or when your body dies of cancer, it will be because your cells have grown too big for your body's complex system of organs, nerves, and muscle to sustain growth of them any longer. Modern financial institutions are like these parasitic cancer cells growing within the body—the planet's body. And these cancer cells spread by increasing the quantity of loans they give to other cells, which they use to absorb them. As they keep getting bigger they extract more and more resources to grow, until they've grown so large that the entire system collapses and the body dies, taking with it the personality, spirit, soul - what have you. This is what is meant by, all things growing only grow towards their death.

Consolidation of Financial Institutions

The first of the three aims of the modern economic cycle has been to consolidate the financial sector into an oligopoly of institutions 'too big to fail'. That this has happened over the past fifty yeats is a fact.

From 1934-1987, the total number of commercial banks in the United States remained steadily between 13,000-14,500. Since 1986 the total number of commercial banks have been reduced from 14,027 to 4,377 in 20203.

Since 1984 the total number of savings and loans banks have been reduced from 3,550 to 627 in 20204.

Consolidation of Assets within Financial Institutions

The second aim has been to consolidate the legal control of assets within this oligopoly of financial institutions 'too big to fail'. That this has happened for the past fifty years is a fact.

As it currently stands in 2022, four New York based financial institutions legally control US$147.9 Trillion worth of assets through custodianship. That is not a typo – Trillion.

$147.9 Trillion

$147.9 Trillion

$147.9 Trillion

$147.9 Trillion

BNY Mellon, US$45.3 trillion in assets under custody and/or administration as of September 30, 20215

State Street, US$43.3 trillion in assets under custody as of September 30, 20216

JPMorganChase, $31.3 trillion in assets under custody as of the September 30, 20217

Citibank, over $28 trillion in assets under custody as of 20218

This fantastic sum is the upstream aggregate amount of assets managed by mutual funds such as Vanguard and BlackRock, which they themselves only account for a small portion of. BlackRock's assets under management(AUM) have risen from $2.7 billion in 1989 to over $10 Trillion in 20229. While Vanguard's AUM has gone from $1.8 Billion in 1975 to $7.2 Trillion in 202110. The relationship between these mutual funds and custodian banks will be made quite clear later on. The nature of this relationship has always been covered in another stand alone article from this site, The separation of control from ownership.

The capital used to acquire most of this came from corporate and government debt. Which is to say, it came from the future. One in which has become the present we are living in' in 2022.

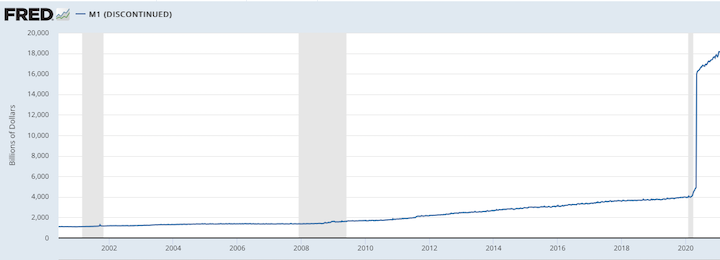

Expansion of the money supply

The following chart shows the expansion of the US money supply, also worlds' foreign exchange reserve currency, since 1975. The use of this chart had to be discontinued in May of 2020 because the US Federal Reserve stimulated the economy so much that charting the money supply became pornographic.

Decline of Middle Class Wealth

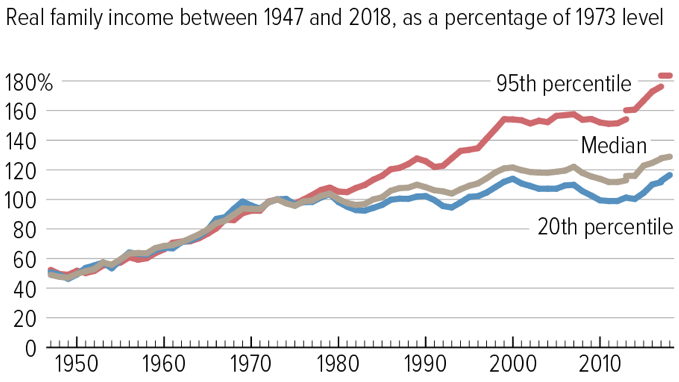

In lockstep with these economic developments real wage growth began to decline during the 1970s.

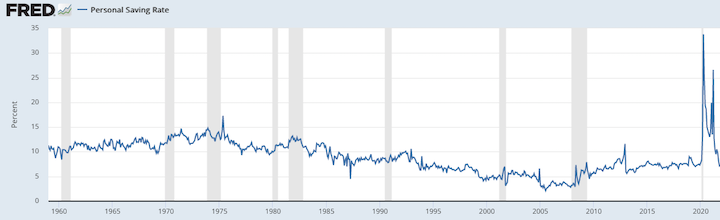

Household savings as a % of income started to dip.

And the disparity in wealth talked about so much these days started to follow all these trends in the 1980s.

These macro trends are very clear. They are confluent from the 1970s onward, but these graphs only account for what has been happening quantitatively. They do not account for the qualitative decline in goods and services since then. Qualitative decline comes from the use of such things as GMO foods, microplastics, chemical fertilisers etc. and other much synthetic methods of achieving artificial growth through supplementing the quality of something for more quantities of it. In the case of foods, chemical farming has been used to increase crop yields at the cost of reducing the nutritional value of crops. The human need for food is found in its nutritional value. More food of less nutritional value does not necessarily equal more food. But as far as technocrats are concerned, it is more food on a bar graph, which means it can be considered growth. And growth is good. Even if this growth is cancer caused by Monsanto roundup.

Now, the reason growth by any means has become necessary is because growth is the only way to stabilise prices in an economy where the money supply is being perpetually expanded. By this is meant, an increase in the quantity of goods and services produced and sold to consumers who have more money to spend it on. This is why there is a growth rate and an inflation rate. In theory, the growth rate is meant to offset the inflation rate. And the inflation rate is meant to increase the growth rate.

The inflationary effects on prices from perpetual expansion of the money supply can only be contained through perpetual expansion of goods and services. This being growth. If growth stagnates, the prices of goods & services will start to inflate. So growth is forever trying to keep up with inflation of the money supply to keep the price inflation of goods and services stabilised. But these 'rates', the inflation rate and growth rate, they are juked. And the modern economy, what many have believed to be an American dream, is just creative bookkeeping everyone is slowly waking up from.

The inflationary effects on prices from perpetual expansion of the money supply can only be contained through perpetual expansion of goods and services. This being growth. If growth stagnates, the prices of goods & services will start to inflate. So growth is forever trying to keep up with inflation of the money supply to keep the price inflation of goods and services stabilised. But these 'rates', the inflation rate and growth rate, they are juked. And the modern economy, what many have believed to be an American dream, is just creative bookkeeping everyone is slowly waking up from. Because real growth is not perpetual, it eventually becomes synthetic growth. Synthetic growth is not perpetual either, as it comes at the cost of diluting quality and often wastage which pollutes the environment, things which in fact minimise the human needs growth is meant to serve. The shift from growth to synthetic growth is the extent to which the quality of a good or service can be supplemented for more quantities of it. For instance. You can make one hundred glasses of orange juice from one by simply watering it down, but at a certain point the substance you are creating becomes orange juice in name only. It will no longer contain the delicious vitamins we seek from it. Because the geniuses at the orange juice corporation supplemented a human need for vitamin for a human desire for sugar.

If pure quantitative growth is good, then cancer is good. Because that is what cancer is. Redundant growth inside your body taxing your organs. And this is what has been created, a cancer economy to soak up the expansion of the money supply with, literally in some cases, cancerous goods and services.

Modern Real Estate Finance

The money supply began to be substantially expanded in the 1970s. Real middle class wealth started to decline since the 1970s. Financial institutions have been consolidated since the1970s. And legal control of private property, commercial and residential, has been consolidated within these since the 1970s.

This is a confluence of four phenomenons(Consolidation of financial institutions, Consolidation of assets within them, Expansion of money supply, Decline of middle class wealth) over the same period of time. They are easily observable through at least data and everyone can agree they are happening. If these four trends continue the logical endpoint is a corporate state governed by financial institutions. One could argue we are already there, but it truly arrives once it becomes openly acknowledged.

However there is rarely any meaningful explanation given by anyone being listened to as to why this is happening, let alone how it is happening. It isn't good enough to explain this process away as simply the capitalist system at work. This kind of shallow analysis, generally offered by those with an ideological axe to grind, falls flat and into an agenda more interested in offering up solutions to problems it demonstrates little understanding of. The intention of this essay is to do the opposite. Provide some understanding of the problem and offer no solutions. There is no gold or bitcoin position to sell you on, and whichever way you cast your vote won't resolve much of anything. Good solutions arise from understanding problems, not by knowing that there are problems. Which is precisely why most people are kept bamboozled when it comes to economic matters, and economic concepts in general. Financial punditry makes Up seem as if its Down, Down seem as if its Up. They shuffle the definitions of words around until financial categories lose all meaning, so that the assets within them can lose value and still be sold to pension funds.

Everything in finance in one way or another eventually takes on an ulterior motive. This is because money is the universal exchange commodity that has a relationship with all other commodities. Through it, everything can effect everything else. So everything done with money can be done in such a way as to provide those doing it plausible deniability. This is why financial institutions always manage to benefit from ostensibly always fucking up. But this would suggest they aren't fucking up. There is also a concerted effort to obfuscate the on-going operations within the financial sector through use of unnecessarily complex jargon, often changed decade to decade or even year to year. Basic concepts like a home loan, gets turned into a bond, which becomes twisted into mortgage-backed securities, that are then collateralised debt obligations, further more exchange traded funds of collateralised debt obligations, and all kinds of derivative acronyms. But all this can be divided into three categories.

| Mortgage | This is a debtor to creditor relation between a property owner and a bank. Generally well understood. | ||

| Mortgage Bonds | When a bank divides a mortgage into lots of little mortgages, called bonds, it then sells on to investors who want to profit off little pieces of the interest rate. This is a 1-to-many debtor to creditor relation between a property owner and investors involving a middle man between the two to represent the bondholders. | ||

| Mortgage Backed Securities | When multiple mortgages are bundled together and then bonds of these bundles are sold. | ||

| Financial Derivatives | These are what confuse most people, and they are specifically designed to do this. The reason they are designed to do this is because if people understood what them, they wouldn't lose money trying to profit off them. To put it very simply, in most cases you can think of financial derivatives as pieces of a bad mortgage the creditor wants to sell to someone else before the debtor defaults on it. | ||

The vital thing to observe between these three types of mortgage relations is the progressive detachment of the creditor from the real asset backing the mortgage.

A mortgage is directly backed by a piece of property, so if the debtor defaults the creditor gets the asset. Simple right.

But a bond isn't backed by the piece of property, it's backed by the mortgage on that piece of property. By this is meant, if a creditor has a bond and the debtor defaults, the creditor does not get the property because they are one of possibly thousands of creditors who all have bonds on the mortgage to that property, and the property cannot be cut up into thousands of tiny pieces and portioned out. What all these creditors have are beneficial ownership rights to the interest payments on the mortgage, or in some cases the profits from the sale of the property should the debtor default. But this means if the debtor defaults the creditors position will often times be negotiated by a middle man. Often times this middleman will not be operating in the bondholder's best interests.

It doesn't stop here though. These bonds can be packaged into all kinds of complex arrangements called mortgage-backed securities. From these are then created all kinds of financial derivatives. For example, there is the derivative called a Real Estate Investment Trust, or REITS, is a bunch of mortgage-backed securities making up the assets held by a company selling shares of itself on the stock market. Those shares can then pay dividends, which are based of the interest payments generated by the mortgages held by the company.

There is no need for it to be this confusing though, even if buying stock for dividends based on the speculative value of someone else's mortgage on a house owned by someone else is confusing. Really what is happening is the creditor is becoming one step further removed from the underlying asset purchased by the debtor using the initial mortgage. By doing this the quality of loans can be reduced and the quantity of them given can be increased because the creditors have been so far removed from the debtors they have no idea who they are lending money to.

Think of it like this. . .

Asset → Mortgage → Creditor (no middle-men)

Asset → Mortgage → Bond → Creditor (now 1 middle-men)

Asset → Mortagage → Bond → Mortgage-backed Security → Creditor (now 2 middle-men)

Asset → Mortagage → Bond → Mortgage-backed Security → REIT → Creditor (now 3 middle-men)

At each step there is a middle man sucking away value. Until some poor fuck called a retail investor, someone who doesn't have enough money to invest in real property, invests in 'real' estate stocks. In many cases these poor fucks don't even buy them, their pension fund does without their knowledge. Then, when something like 2008 comes along, their savings disappear.

A mortgage-backed security is kind of like a Non Fungible Token, or NFT, only not so far detached from reality. If you don't know what an NFT is, it is nothing. So imagine an NFT, only the value is backed by beneficial ownership rights to part of a mortgage on something. Which really just demonstrates what an NFT is, a nothing-backed security. Not even paper with beneficial ownership rights to vaguely something. Only the actual paper itself. Like a little gold star teachers stick on children to make them feel distinguished. And children grow out of this in kindergarten once they learn these stickers can be purchased in bulk from a dollar store. Hence the shift to report cards.

The rest of this essay covers the three crisis cycles as iterations in a broader economic conspiracy perpetrated by a coalition of Rockefeller associated financial institutions. And finally how these integrate into what has been happening since March of 2020, and the creation of new Environmental, Social, Governance institutes.

The First Cycle: 1970-1990

Abolishment of the Gold Standard

In August 1971 a small contingent of advisors met secretly with Richard Nixon at Camp David and persuaded him to abruptly abolish the gold standard as it applied to US dollars on the foreign exchange market. This devaluation of the US dollar led to a decrease in the real income of OPEC oil producers.

''In 1970, slightly more than 10 barrels of oil would purchase an ounce of gold.8 By the next year, when the Bretton Woods agreement ended, with gold priced at $42 and oil fixed in terms of U.S. dollars at $3.56, oil sellers needed nearly 12 barrels of oil to buy an ounce of gold. This “real” oil price decline, and general worldwide inflattion did not go unnoticed in the oil-producing countries. In 1971, OPEC built in a 2.5 percent annual inflation factor by which to adjust the nominal (U.S. dollar) price of oil. Yet, by mid-1973, nearly 34 barrels of oil were required to buy an ounce of gold. In little more than two years, the gold price of oil had fallen by more than 70 percent, and the oil price of gold had risen by almost 200 percent.'' 11

In response OPEC raised the dollar price of oil, which in turn caused a trickle down effect of rapid price inflation for goods and services across the broader American economy during the 1970s.

''On January 1, 1974, OPEC raised the U.S. dollar price of oil from $4.31 to $10.11, producing the first dramatic price shock. After this increase, the “gold price” of oil (at 12.8 barrels per ounce of gold) was back within its historical range. For the rest of the decade, including the second dramatic price rise in 1979, the gold price of oil stayed within its historical range. At the end of the decade, 14 barrels of oil exchanged for an ounce of gold, well within its historical range but with a “real” price approximately 25 percent lower than at the beginning of the decade.'' 12

An oil cartel price gauging operation orchestrated by the 'nefarious' Arabs of OPEC is generally blamed for the inflationary crisis of the 1970s in pop-history, but this is untrue. It was Nixon's decoupling of the US dollar from gold on foreign exchange markets that compelled OPEC to hike their oil prices in response.

Two of the primary advisers who attended that consequential meeting at Camp David were Peter G. Peterson, Presidential advisor on international economic affairs, and Paul Volcker, Undersecretary of the Treasury for international monetary affairs. Also in attendance was Secretary of the Treasury and former Texas governor John Connally. Connally was riding in the motorcade when JFK's head went back and to the left and was the same governor who got that 'magic bullet' lodged in him. In fact, if there is a clear cut genesis to all the economic developments to be outlined here, it could be argued it began with the end of the Kennedy administration. When LBJ took over all the new dealers were purged and replaced with the Henry Kissinger types, then people started to receive all kinds of new credit cards in the mail.

Connally is generally pointed to as a primary influence behind Nixon's decision. But the man was a career politician, and before that time he had been in the Navy. So it's hard to believe any economic policy position he held would've been his own, as opposed to that of say, his under secretary Volcker. Further more, there's evidence Connally was taking policy directions directly from Peter Peterson on how to go about abolishing the gold standard.

An October 26 1971 memo from Peter Peterson to Secretary Connally on administration strategy noted:

''The surcharge provides little leverage against France, and France does not abhor the trade wars and bloc formation which could develop. We can therefore achieve an effective French revaluation only by devaluing the dollar... . The United States should agree to devalue the dollar against gold by 5% to 8% if the following monetary conditions are met: 1. Simultaneous revaluations of at least 10% by Japan and 5% by Germany, leading to effective exchange rate changes of at least 15%-18% for Japan; 10%-13% for Germany; and 5%-8% for France, Italy, Britain (hopefully)'' 13

Connally merely ratified the decisions made by Volcker and Peterson, who acted as an information authority to him regarding the policy position to abolish the gold standard.

The reason behind for policy, at least ostensibly, was to devalue the US dollar to attract foreign investment to sure up domestic production, which meant more jobs. This was how it was sold to Nixon, a job creation vote winner.

''In addition, the administration focused on export promotion. Peter Peterson, an adviser on international economic policy in the White House, focused attention on U.S. competitiveness and the number of jobs created by additional exports. The notion that a lower foreign exchange value of the dollar could create jobs in traded goods industries, to the political benefit of the administration, was widely discussed within the administration.

With this trade policy backdrop, and with U.S. gold reserves at increasing risk due to the growing accumulation of dollars abroad, the Nixon administration began preparing for changes in the international monetary system. Paul Volcker, the Undersecretary of Treasury for Monetary Affairs, headed an interagency planning group to prepare for the possible closure of the gold window and other actions to persuade foreign countries to adjust their exchange rates. Although it would constitute a big change in policy, closing the gold window was relatively straightforward to implement and would immediately end concerns about the loss of U.S. gold reserves. '' 14

Paul Volcker

NY Federal Reserve Chair, Chase Manhattan Bank, US Treasury, US Federal Reserve Chair, Trilateral Commission, Council on Foreign Relations, Bilderberg Group.

Paul Volcker was a Harvard grad who had spent time as a research assistant with the New York Fed in the 1940s. It appears he had initially taken up the Austrian school of economics in his senior thesis, but got a Rotary scholarship to study at the London School of Economics in 1951 after he graduated, probably to school him on a more Keynesian outlook. After that he returned to the New York Fed full time before going to work for the Rockefeller's Chase Manhattan in the 1960s. By the time Volcker had entered Nixon's treasury department in 1969 he had spent the better part of two decades inside of Rockefeller institutions. He would go on to become a member of the Council on Foreign Relations (CFR), Chairman of the Federal Reserve, and gain a bunch of other neo-peerages bestowed upon those made by and loyal to the Rockefeller family. For most of his career he would play the part of an inflation hawk, perched atop the Federal Reserve putting an end to business cycles by hiking interest rates. But back in 1971 he was behind the most inflationary economic policy of the 20th century.

''In 1971, Mr. Volcker played a key role in persuading Nixon to suspend the Bretton Woods agreement by closing the “gold window,” meaning the United States would no longer guarantee the value of the dollar.'' 15

''On Friday afternoon at Camp David, the president and his advisers met to discuss the proposed Treasury package. Federal Reserve chairman Burns strongly opposed closing the gold window, but this position received no support. Volcker recalled that “the only really active debate about the program was over the import surcharge. As I remember it, the discussion largely was a matter of the economists against the politicians, and the outcome wasn’t really close. I think the president had been convinced that it was both an essential negotiating tactic and a way to attract public support'' 16

Peter G. Peterson

Blackstone Group, US Secretary of Commerce, Lehman Brothers, Trilateral Commission, CFR Chairman, Bilderberg Group.

Peter G. Peterson had graduated from the Chicago Graduate School of Business in 1951 where met George Schultz, the school's Dean at the time. After a few years in the private sector at the Bell&Howell corporation, Peterson was appointed chairman of the Commission on Foundations and Private Philanthropy in 1969. It was a private study group put together by John D. Rockefeller III to advise Congress on whether private philanthropic organisations should be taxed 17. The Peterson Commission as it came to be known, found that in fact oligarch owned philanthropic foundations should not be taxed, and who was Congress to argue with the experts? And who are we today? It was through Schultz that Peterson was pulled into the Rockefeller orbit. Schultz was apart of the Peterson commission while also serving within the Office of Management and Budget at the time. After Peterson's commission had secured the Rockefeller Foundation its tax exemptions, Schultz brought him into the Nixon administration as a Presidential economic advisor in 1971, and only months before that infamous Camp David meeting in August. During his brief tenure Peterson swiftly gained an apparent reputation as am “economic Kissenger” 18. Schultz had accompanied Peterson to the Camp David meeting, and both men moved into the Treasury Department together for a brief period in following year of '72 to oversee in the initial implementation of devaluing the US dollar.

Putting aside the justification of this policy given by Peterson and Volcker at the time, we know that the effects of it compelled OPEC nations to raise their oil prices, which then trickled down into hyper-inflationary prices for goods and services. So the interesting question becomes whether Peterson and Volcker knew what they were doing. And if they did know, why did they do it? It's hard to believe the effect on the price of oil hadn't been factored in given oil was, and still is, the kernel commodity of industrial society. At the very least it is reasonable to conclude that the way in which gold was decoupled from the US dollar was responsible for inducing 1970s hyper-inflation, and that these two men were most responsible.

And the response to this inflationary crisis became that of another. The Savings & Loans crisis of the 1980s.

The Savings and Loan Crisis

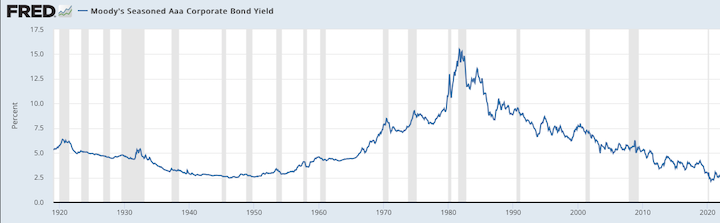

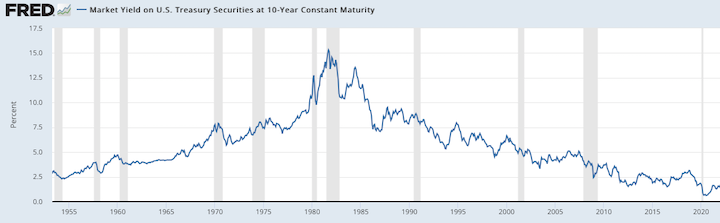

In August of 1979 Paul Volcker was appointed Chairman of the US Federal Reserve and began to raise interest rates to suppress the price inflation of goods and services. The relationship between interest rates and prices is through the availability of cheap credit, or bank loans. If interest rates are low more people take out loans to buy things. These things raise in price because more people are buying them. This means higher prices. Inversely, raising interest rates mean less people take out loans to buy things. This means less things are being bought which means lower prices. This is a theory alot of people play around with though, and granted, there are more moving parts to the economy than the supply of credit.

Interest rate hikes happen at the central banking level through fund rates or discount windows. These determine the interest rates at which retail banks borrow money, which in turn should trickle down into the rates they give the general public. Though this is not always true. The central bank rates are the ones being discussed here, as they are centralised and easy to monitor for overall trends in the cost of credit. The trickle down effects of them vary however.

When Volcker became Chairman interest rates had already been hiked to 11%. For two years he incrementally raised interest rates to fluctuate between 10-20%, mostly on the high end of that spectrum. Then in 1982 he began to lower them.19. This had a deflationary effect on the prices of goods and services, as was the ostensible intention. However, in doing this Volcker had also caused savings and loans banks(S&Ls) to develop what is known as an asset-liability mismatch. This happened because the rate of interest banks were lending at became substantially lower than the rate of interest they had been borrowing at. On account of this S&Ls banks were haemorrhaging money.

What had been a jobs crisis in 1970 quickly became an inflationary crisis and eventually a banking liquidity(this means avaliable cash) crisis by 1980.

To remedy the liquidity crisis Congress were advised to deregulate the S&L industry to help generate more money for themselves. This was achieved through two pieces of legislation::

- The Depository Institutions Deregulation and Monetary Control Act of 1980

- The Garn–St. Germain Depository Institutions Act of 1982

What happened next was the Savings & Loans Crisis of the 1980s. But calling it this is misleading because it was really a commercial real estate scam. An independent journalist(this is back when they existed) called Rob Widdowson provided a very thorough and easy to understand explanation of the S&L crisis on the community cable network show Alternative views in 1990, not long prior to him becoming a fugitive for manufacturing a slightly altered version of MDMA called Heaven. Here are the audio files of those episodes.

AV Ep 410 Savings and Loans Stolen LootedAV Ep 422 Savings and Loans Update

AV Ep 423 Savings and Loans Update 2

What this deregulation did was increase the amount of commercial loans banks could make and increased the proportion of assets that banks could hold in residential and commercial real estate. Then in March of '82 Volcker at Fed began to lower interest rates incrementally from 15% down to around 8%, where they hovered throughout most of the mid-80s 20.

What deregulation of S&L industry did was increase the amount of commercial loans these banks could make and increase the portion of assets they could hold as residential and commercial real estate. Then in March of 1982 Volcker at the Fed started to lower interest rate, down incrementally from 15% to around 8%. This confluence of low rates of interest and deregulated lending practises led to an outflow of cheap credit to property developers, such as Donald Trump, who used it to buy up large swathes of commercial real estate. This created lots of commercial property mortgages along with a commercial real estate bubble between the years of 1982 until and 1985.

During these three years there was no actual increase in the demand for commercial property. Demand had been manufactured entirely on the supply side. And at some point these properties needed to be leased to a tenant or purchased by an owner occupier. But since there was no actual demand, they couldn't be sold or leased once they had been developed, and due to this started to become liabilities through their carrying costs of maintenance and management fees plus property taxes.

Because of this property developers, such as Donald Trump, started to default on the loans used to purchase commercial property around about 1985, and the S&L banks which held the mortgages on these began to acquire them through foreclosure. However, the banks couldn't sell these properties either because there was still no REAL demand for them. So the banks had really just acquired the burden of having to pay for the upkeep and taxes on all these empty buildings.

It wasn't long before the FSCIC, the insurance fund banks pay into for rainy days like this, had been completely drained and the S&L banks were becoming insolvent. Which meant they would no longer be able to account for the money in their depositor accounts. It simply wasn't there.

In response, the government started to liquidate these insolvent banks by paying off their depositors using taxpayer funds in exchange for acquiring their assets, which of course were largely made up of foreclosed commercial properties.

Some S&L banks managed to avoid or postpone insolvency by getting the commercial properties off their books through selling the mortgages on them to wall street banks, who had then been bundling them into mortgage-backed security packages, which had then been sold on to private or retail investors. Now, why would private buyers agree to bulk purchase the interest bearing mortgage bonds on defaulting commercial properties? Because the government started to guarantee the payment of interest on them through the publicly owned corporations of Freddie Mac, Fannie Mae and Ginnie Mae. Which is to say, private businessmen were used to funnelled these terrible commercial property mortgages from wall street banks back onto government books by making these defaulting commercial mortgage-backed security bonds into what were effectively US Treasury bonds.

To summerise this process thus far.:

- 1980-1982 Legislation deregulated S&L banks and the Federal Reserve lowered interest rates. This allowed S&L banks to make lots of commercial property loans

- 1982-1985 Property developers took advantage of this by taking out lots of loans to buy and develop commercial property. This created a commercial property bubble.

- 1985 Because there was no demand for these properties, the developers could not sell or rent them after they had been developed, and began to default on the mortgages used to acquire and develop them.

- 1985 The S&L banks who owned these mortgages started to foreclose on them, which in turn rendered them insolvent because they couldn't sell or rent these properties either.

- 1985-1988 The US government started to liquidate these insolvant banks to pay off their depositors, and in the process acquired all the commercial real estate that had been foreclosed on.

If this story sounds familiar it's because the same thing happened again in 2008, only with residential property. More recently a similar same scam has been going on in China since 2008, only with entire cities. Which is why China's largest property developer, Evergrande, is in the process of going bust 21.

By 1989 the US government had become the largest commercial real estate holder in the United States, and the government agency charged with managing it all was called the Federal Deposit Insurance Corporation, FDIC. And it was here, in the wake of the S&L crisis, the Blackstone Group and its progeny BlackRock Inc. began to emerge as the new dominant financial institutions of the 21st century.

The Blackstone Group

After advising Nixon to abolish the gold standard back in 1971, Peter G. Peterson had left the administration for the private sector in 1973 where he joined Lehman Brothers. There he became both Chairman and CEO and met Stephen A. Schwarzman, another executive at the firm. Both men left together to found the Blackstone Group in 1985.

It was during Blackstone's founding year of 1985 Peter Peterson had also been handpicked by David Rockefeller to succeed him as Chairman of The Council on Foreign Relations, a position Rockefeller had held for the preceding fifteen years. 22. And Peterson's connections to the Rockefeller family don't stop there. He was trustee of the Rockefeller Japan Society, sat on the board of the Rockefeller family's Museum of Modern Art, and would eventually end up as Chairman of the Federal Reserve Bank of New York. The point being made here is crucial. . .Rockefeller, Rockefeller, Rockefeller, Rockefeller. . .Peter Peterson was a Rockefeller agent. The Blackstone private equity group he founded was a Rockefeller institution. Now, if one were insist on an unrealistic burden of proof for such a contention, such as substantive evidence found in the paperwork of controlling rights, then of course I would be shit out of luck. This statement could be normalised somewhat, by saying the Blackstone Group is rather an emergent institution of the Rockefeller family legacy, a legacy since disbursed into a fractured power array of confused estate holding between innocuous heirs. But this wouldn't be precise, as it sows doubt as to whether the Blackstone group was a Rockefeller institution. And historical evidence combined with reasonable intuition would suggest that the Blackstone Group was a Rockefeller financial institution.

Stephen A. Schwarzman

Yale Skullk&Bones, Lehman Brothers, Blackstone, CFR.

The groups co-founder Stephen Schwarzman has less extensive ties to the Rockefeller faimly. Though he does live in David Rockefeller Jr's former NY residence.23, The groups co-founder Stephen Schwarzman has less extensive ties to the Rockefeller faimly. Though he does live in David Rockefeller Jr's former NY residence, and is a man with an interesting history of his own.

Schwarzman graduated from Yale class of 1969 as a member of quasi-secretive Skull & Bones soceity. He would've been initiated into that society as a neophyte by the fifteen or so members of the graduating class above him, that of 1968 which included none other than George W. Bush 24. After Yale he attended Harvard business school and graduated in 1972. He joined Lehman Brothers the exact same year as Peterson in 1973, where he remained until he joined Peterson, who was his boss at Lehman's, in founding his Blackstone venture.

The Blackstone Group had been initially founded as a mergers and acquisitions consultancy firm, but it had quickly pivoted into private equity through a suspiciously well timed fundraiser of capital in the lead up to the 1987 stock market crash25. Blackstone had timed these fundraising activities so perfectly they had concluded them the very day before the black monday crash occured on October 19th.

''After a carpet-bombing campaign of 488 solicitation letters, Peterson and Schwarzman eventually raised $635 million, closing the initial fundraising the day before the stock market crashed in October 1987. As Milken's money machine proceeded to break down, hundreds of junk-bond-laden thrifts were put into receivership. When the government's Trust Corp. started auctioning off billions in troubled assets, Schwarzman & Co. was flush and ready to buy. It began snapping up dozens of apartment buildings in places like Arkansas and Texas. Blackstone's real estate business was born out of the S&L crisis.''

Roger Altman

Blackstone Group, US Secretary of Commerce, Lehman Brothers, Trilateral Commission, CFR, Bilderberg Group

To help with Blackstone's pivot into private equity Peterson and Schwartzman had brought over another former Lehman Brothers executive, Roger Altman, in 1987.

Altman had worked worked with Peterson in the 1970s but left Lehman Brother's in 1978 for a role as Assistant Secretary for Domestic Finance within the US Treasury under Jimmy Carter. While there the two major pieces of legislation deregulating the banks had been formulated, though there is no evidence of a direct connection between him and this. However, Altman did go back into the Treasury under the Clinton after his time at Blackstone to take control of the Resolution Trust Corporation(RTC). To understand the significance of this more must be said about the fallout of the S&L crisis.

By the end of the 1980s the US government had become the largest holder of commercial property in the United States, and this had placed them, or the American taxpayer if you will, in quite a precarious position. On one hand the government needed to get rid of these assets because their carrying costs, that is, the on-going costs of maintaining them, made holding onto them a liability. But on the other hand, if they got rid of these properties by dumping them back onto the open market, the market would collapse even more than it already had from an excess of supply, which would likely drag the US economy into a depression. This because the price of property had all kinds of externality effects due to the amount of financial mechanisms pegged to them though creative bookkeeping practises.

The part of the government in charge of managing these commercial properties was the Federal Deposit Insurance Corporation, or FDIC. What it had started to do with these properties was auction them off in bulk packages at extremely discounted prices to private equity firms, such as Blackstone, which in turn would agree not to dump them back onto the market for a certain period. However, these private equity firms were actually selectively purchasing only the good assets the FDIC had acquired from insolvent banks at these discount prices. Which meant all the bad commercial property, which was actually what the government should've been trying to get rid of, was left on government books to burn a hole in taxpayer pockets. Which is where Larry Fink and BlackRock Inc. enter the picture.

Larry Fink

Blackstone Group, BlackRock Inc, Council on Foriegn Relations, World Economic Forum

Larry Fink

Fink begun his career at First Boston in 1976 as a bond trader, but swiftly shifted over into the emerging market of mortgage-backed securities, where he became a pioneer of the kinds of debt-securitisation that has plagued the economic landscape ever since. He joined Blackstone in 1988 as the head of a new department called Blackstone Financial Management (BFM). His department was injected with $5 million in seed capital by Peterson and Schwartzman and its personnel was made up of Fink's former asset management team at First Boston which he had brought over with him.

In 1989 'The Financial Institutions Reform, Recovery, and Enforcement Act' was signed into law by George H. W. Bush, who had served alongside Peterson within Nixon Administration back in 1971, and whose son, George W. Bush, had initiated Schwarzman into the Skull&Bones society in 1968.

The act was ostensibly a regulatory response to what had occurred in the S&L industry during the 1980s, but it was also a poison pill which tacitly privatised FDIC operations. While at the same time it created new government agency called the Resolution Trust Corporation, or RTC.

That year Larry Fink's Blackstone Financial Management won a contract to become an asset manager of the FDIC holdings. This meant Fink and his department took control of the commercial properties acquired by the government from the bank bailouts. BFM started to auction these assets off on behalf of the government, in some instances to Blackstone which it worked for, which was then acquiring them auction.

''Fink started the advisory business in 1988, almost literally in the ashes of First Boston. His first client was a savings-and- loan institution, an industry he knew well. With help from the major Wall Street firms, including First Boston, the S&L industry had expanded too rapidly and made poor investments. By the late 80s, the industry was on the verge of failure, and one of Fink’s next clients was the Federal Deposit Insurance Corporation. Until the Resolution Trust Corporation was established, the F.D.I.C. hired him to manage the assets of S&Ls that had been taken over by the government. ''

The Resolution Trust Corporation had been created as a parallel agency to the FDIC to assist in the disposal of government owned commercial property holdings. It fell beneath the control of the FDIC until 1992, so it can be treated synonymously for its first three years of life.28.

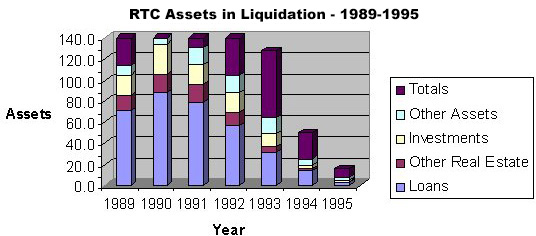

''At the beginning of 1989, the FDIC held $9.3 billion in failed bank assets. By the end of 1989, the FDIC was managing the disposition of $25.9 billion in assets from failed institutions, a substantial increase over 1988.''

''On August 9, 1989, the RTC assumed control of 262 insolvent thrift associations with total assets of $115.3 billion and which had been in conservatorship. During the months that remained in 1989, 56 additional thrifts with total assets of $26.4 billion were placed into the RTC's conservatorship program for a total of 318 thrifts. The RTC resolved 37 institutions with total assets at the time of resolution of $10.8 billion during that period. A total of 281 thrifts remained in conservatorship at the end of the year. Those 281 thrifts had a total asset book value of $104.9 billion as of December 31, 1989.''

What the RTC and FDIC were doing was slowly disposing of all the good assets at highly discounted prices. Instead of say, auctioning off individual assets at prices individual buyers would pay, they bundled multiple assets into asset packages, which they then sold at a bulk discount price, though this price would still be high enough to restrict prospective buyers to institutional investment funds like Blackstone. Eventually, after this had been done, they would then, and only then, start disposing of all the bad stuff, which of course would increase the value of all the good stuff already sold. More on this later.

''Democrats and Republicans in Congress say Patriot was offered exceptionally generous terms, such as a seven-year no-interest loan, that could come at the expense of taxpayers who already have paid $80 billion for the bailout. Private real estate brokers charge that other buyers were willing to pay more for individual properties than Patriot.

Details of the package sale agreement, announced in August, still are being worked out. Its fate takes on added importance because RTC, the federal agency created to manage the S&L bailout, wants to package other bundles of property worth hundreds of millions of dollars to expedite the sale of property from failed S&Ls. The agency said generous terms were necessary to move large numbers of properties, which include hard-to-sell assets.''

Stock Market Crash of 1987

In the 1980s automated computer trading was just starting to take off. The financial firms using these trading algorithms effectively started to indirectly synchronise their trading strategies, like a cartel of sorts. Since they were all using the same software, certain market events triggering this software would initiate massive buyups or selloffs. As a result on November 19 1987 these algorithms for some reason triggered a massive and unexpected stock selloff, which instigated the black monday crash on November 19th. After the crash occurred the stock exchanges responded by taking these automated trading system offline 32. These days BlackRock's proprietary trading software Aladdin is used ubiquitously across the financial sector and controls the ETF market.

The crash was also apart of a broader pattern. The stock market had plateaued after a long 1970s bullrun around 1980. It then began to inflate back up in 1982 due to the lowering of interest rates and the deregulatory acts allowing banks to increase the availability of commercial credit, much of which ended up in stocks. So a crash was looming on the horizon from the gradual retraction of this cheap credit.

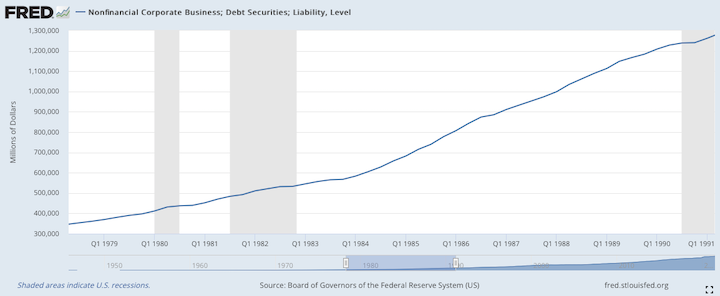

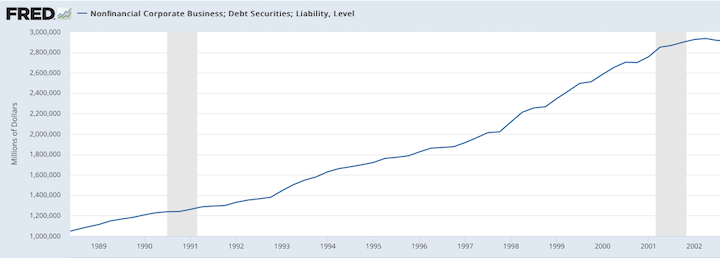

The following chart shows corporate debt levels during in the 1980s. The amount of corporate debt ticks up in Q4 of 1983 and continues on this trajectory until Q3 and Q4 of 1986, when it starts to flatten out a little. This amounted to roughly a $300 Billion increase.

Major corporations don't go bankrupt anymore, yet many are insolvent. These are called zombie corporations. Because instead of bankruptcy, what we have these days is called a leveraged buyout. When a corporation becomes insolvent, instead of going bankrupt, it is acquired by another corporation using a bank loan, which is called leverage. The acquiring corporation acquires the old debt from the insolvent corporation and uses this new 'leverage' to pay off or service the old debt it has taken on.

Thus, the old debt which couldn't be paid, is paid off using a loan created from new debt which can't be paid, but with a new due date further in the future. Which means the debt is really just being transferred to the acquiring company, but with an extended due date. However, as this process continues, all the debt being acquired from these insolvent corporations begins to amass within the fewer and fewer big enough to acquire them, which in turn are becoming too big to fail. The endgame here, should it be reached, would be that all corporate debts accumulate within monolithic corporate conglomerates that have acquired all other insolvent corporations in their industry, along with their debts, yet these can never be allowed to go bankrupt, as an entire industry would collapse if they did. Thus other options would be explored.

Second Cycle: 1990-2010

In 1992 Blackstone Financial Management separated from the Blackstone Group and became its own corporate entity called BlackRock Inc. with Larry Fink as CEO and around $17B assets under management. 33.

That year the Resolution Trust Corporation, which had been apart of the FDIC till that point, was moved into the purview of the Treasury.

'' Various changes mandated by the enactment of the RTC Refinancing, Restructuring, and Improvement Act (RTCRRIA) of 1991 on November 27, 1991, were implemented in 1992. The changes included funding through April 1, 1992; extension of the time frame to accept appointment as conservator or receiver; establishment of the Thrift Depositor Protection Oversight Board; removal of the FDIC as exclusive manager of the RTC; and creation of the office of chief executive officer of the RTC. Pursuant to RTCRRIA, Albert V. Casey was named chief executive officer''

During the three years the RTC had been managed by FDIC contractors like Larry Fink, it had been rapidly drained of all its performing assets.

''To be sure, all is not neat and clean. Even the best estimate of RTC Chairman Albert V. Casey is that his agency will leave up to $60 billion in bad S&L assets for the Federal Deposit Insurance Corp. to handle. RTC also leaves behind bitter criticism that it was too quick to sell off assets at fire sale prices to big investor groups and too harsh in liquidating troubled S&Ls.''

Roger Altman left Blackstone in 1992 to become Deputy Secretary of Treasury within the Clinton Administration, where he took control of the RTC, which had just been tranferred over from the FDIC to the Treasury.36. While managing RTC assets Altman became embroiled in the infamous 'Whitewater scandal', that eventually led to his resignation in 1994. After this he founded his own private equity fund called Evercore in 1995.

''Mr. Altman's Treasury job forced on him a similar juggling of roles, but under harsher scrutiny. Early in his tenure, he took on an additional task: acting head of the Resolution Trust Corporation, which administers insolvent savings and loan associations.''

During Altman's brief two year stint he had managed to auction off 39% of the RTC's $102B assets held at the beginning of 1993.38. By 1995 the RTC had been drained of almost everything except junk bonds and commercial mortgage-backed securities.

After the RTC had been transferred over to the Treausry and into the hands of Altman, it had begun to issue Commercial Mortgage Backed Securities(CMBS) using the junk bonds and subprime mortgages it had acquired from the insolvent S&L banks aswell.

''During the first two months of 1992, the RTC consummated its first manufactured housing and commercial mortgage securitizations, RTC 1992-MH1 and RTC 1992-C1, respectively. The RTC issued an internal circular requiring securitization to be the primary and priority method for selling all performing loans secured by one-to-four family homes, multi-family properties, commercial real estate, and manufactured housing contracts.''

''In 1992, the RTC used Multiple Investor Funds and N Series securitization transactions to dispose of nonperforming and subperforming loans, as well as real estate owned to a lesser extent. The benefits of those programs were access to a broader investment base than was available through other disposition strategies, a potential upside economic interest for the RTC, and a structure to ensure that asset managers' interests were parallel to those of the RTC. The RTC also developed a securitization program for nonconforming single-family mortgages, multi-family loans, and commercial real estate loans.''

In this way Altman and Fink, both former Blackstone men who had ostencibly cut ties with the group the same the RTC started to issue CMBS, began to bundle these leftover RTC assets into complex arrays of investment vehicles like Collateralised Debt Obligations, or CDOs. Doing this confused the underlying value of the individual mortgages mixed within them so that they could be sold on to passive investors paying little attention to what they buy. In conjuction with this, what are called Real Estate Investment Trusts, or REITs started to be used to get commercial real estate off the government books and back onto the market. REITs were companies created for the sole purpose of purchasing these commercial real estate holdings from the RTC and FDIC. These companies made up entirey of these property holdings were then floated onto the stock market to cover the costs of acquiring these undesirable assets.

The secondary effect of this was the commercial property market started to heat back up. Which meant the assets previously auctioned to private equity firms between the years 1988-1992 began to appreciate in value. 40.

Put simply. The performing assets acquired by the FDIC and RTC were auctioned off to private equity groups early on. After which the non-performing assets were dumped onto the market through publicly traded real estate corporations. Buy low. Sell high. Or. . .crash markets so you can buy low, then afterwards inflate them back up so you can sell high. And this can be done if you gain control of the Federal Reserve and Treasury.

From its role in all this BlackRock had amassed $165bn AUM by 1999. Much of this was made up funds that used pension fund capital to buy the stock of the REITs being used to buy all the non-performing commercial property from the government. That year Larry Fink also launched BlackRock's IPO through Merrill Lynch in another well-timed fundraiser, reminiscent of Blackstone's in 1987, in preparation for the looming dot com crash that occurred the following year. What caused the dot com crash is fairly apparent, but what fuelled the irrational speculation was once again the expansion of easy credit made avaliable through retail banks, just as was the case in the 1980s.

In the wake of the crash Blackstone, by then under the solitary command of Schwarzman, started to buy up large chunks of corporate stock in pretty standard vulture capital activities. Peterson had left the group in the 1990s for various behind the scenes positions within policy groups surrounding the Clinton administration. Then in 2000 he was more notably appointed Chairman of the NY Fed.

In response to the market crach interest rates were incrementally cut from 6.5% down to 1% between the years 2000 and 2003. This stimulus of cheap credit into the economy combined with three legislative acts would eventually culminate in what transpired in 2007 and what followed it in 2008 as the Golbal Financial Crisis(GFC).

The first of these acts was the Gramm-Leach-Bliley Act of 1999. What this did was remove a prior law that had prevented mergers and acquisitions between large financial firms. Granted, such a law had been largely ignored by the Rockefeller institutions, which granted themselves dispensation via the Federal Reserve. This was done in a 1996 merger between Chemical Bank and Chase Manhattan Bank, then again in 1998 with a merger between Citicorp and Travellers Insurance.

The second was the Commodity Futures Modernization Act of 2000. That deregulated credit-default swaps and other financial derivatives used to pass financial liabilities onto unwitting investors. It was spearheaded by Laarry Summers who at the time was at the Treasury and was signed into law Bill Clinton. It is interesting to note both men had close ties to Jeffrey Epstein around this period.

In the 1990s financial institutions began to appoint academics rather than their own employees to positions within the Federal Reserve and Treasury to obfuscate the revolving door between these two 'government' institutions and their own. Larry Summers was a Harvard economist who later became its President after his time in the Treasury. Between 1998-2005 he was listed in the flight logs of Epstein's private plane four times, and while President of Harvard he had approved Epstein's endowment of the 'evolutionary dynamics program' which is what had placed Epstein within the orbit of other high profile academics and scientists.41.

''Indeed, Epstein shares a special connection with one of the most prominent figures at Harvard—University President Lawrence H. Summers.

Summers and Epstein serve together on the Trilateral Commission and the Council on Foreign Relations, two elite international relations organizations. Their friendship began a number of years ago—before Summers became Harvard’s president and even before he was the Secretary of the Treasury—and those close to Epstein say he holds the University president in very high regard. “He likes Larry Summers a lot,” Epstein’s friend and Frankfurter Professor of Law Alan M. Dershowitz says. “He speaks well of Larry, and I think he admires Larry’s economic thinking.''

Since academics like Summers didn't work in the private sector the financial institutions couldn't compensate them through direct salary. What started to happen was money began to be laundered to them through paid speeches, from which they earnt millions. This was done for Summers in 2008 as a payoff for his time in the Treasury back in 1999. The banks that paid Summers these fees were the same ones involved with MBSs and credit default swaps: Bank of America, JP Morgan Chase, Wells Fargo, Citigroup, and Morgan Stanley 43.

Finally, the third piece of legislation was the Economic Growth and Tax Relief Reconciliation Act of 2001. This cut the capital gains tax on stocks and property. It also created new types of pension funds to seduce middle class savings into aggregated capital funds which could be used to buy up mortgage-backed securities and stock. Pension funds like these eventually took a trillion $ hit in 200844.

All this was cultivation for the ripe unregulated market mortgage-brokers would come to operate in, and which eventually culminated in the GFC. There's no need to get into the specifics of the financial directives which caused it. These were all sleight of hand. A nonsense used to shift the losses accumulated by bad lending practises, from those who made them over to middle class savings. This was realised in a number of ways, either through pension funds being wiped out, government bailouts using taxpayers money. . .or by slightly higher prices for poorer quality goods and services due to expansion of the money supply used in the bailout packages(for those MMT zealots who would deny the former contention).